Table of Contents

Introduction

Can Salesforce email marketing for financial services meet strict compliance, data security, and customer trust requirements?

On paper, Salesforce makes email marketing look straightforward. In practice, every message sent by a bank, fintech firm, insurer, or wealth management company carries regulatory responsibility. One misstep can lead to audit scrutiny, customer complaints, or internal risk reviews.

That tension is why many financial services teams hesitate to rely on Salesforce for email marketing, even when it already powers their CRM.

The real question is not whether Salesforce can send emails. It is whether Salesforce email marketing fits the governance, consent, and audit requirements of regulated financial services teams.

What is Salesforce email marketing for financial services

Salesforce email marketing for financial services is the use of Salesforce CRM to send and manage customer emails while meeting financial industry requirements for compliance, data security, consent, and audit readiness.

Instead of treating email as a standalone marketing channel, financial services teams use Salesforce to keep email communication directly tied to customer records, permissions, and internal controls. This approach helps banks, fintech firms, insurers, and wealth management teams communicate with customers while maintaining regulatory oversight.

How it differs from generic Salesforce email marketing

Salesforce email marketing for financial services differs from generic Salesforce email marketing because it prioritises control and accountability over speed and volume.

Key differences include:

- Governance-first access: Only approved users can create, send, or modify emails, reducing internal risk.

- Record-level consent enforcement: Emails follow customer communication preferences stored inside Salesforce.

- Audit-ready visibility: Every email is logged against the customer record for compliance review.

- Risk-aware usage: Teams focus on service, transactional, and regulated marketing communication rather than unrestricted bulk sends.

When native Salesforce email capabilities fall short of these requirements, financial services teams often add Salesforce-native tools from the AppExchange, such as MassMailer, to strengthen governance and visibility without moving data outside Salesforce.

With this distinction clear, the next section explains how Salesforce supports email marketing in financial services, focusing on the controls that make compliant communication possible.

How Salesforce supports email marketing in financial services

Salesforce supports email marketing in financial services by keeping customer communication controlled, traceable, and aligned with regulatory requirements inside the CRM.

Instead of relying on disconnected email tools, Salesforce lets financial services teams manage email activity where customer data, permissions, and access rules already exist.

As a result, teams reduce compliance risk, improve oversight, and maintain a single system of record for regulated communication.

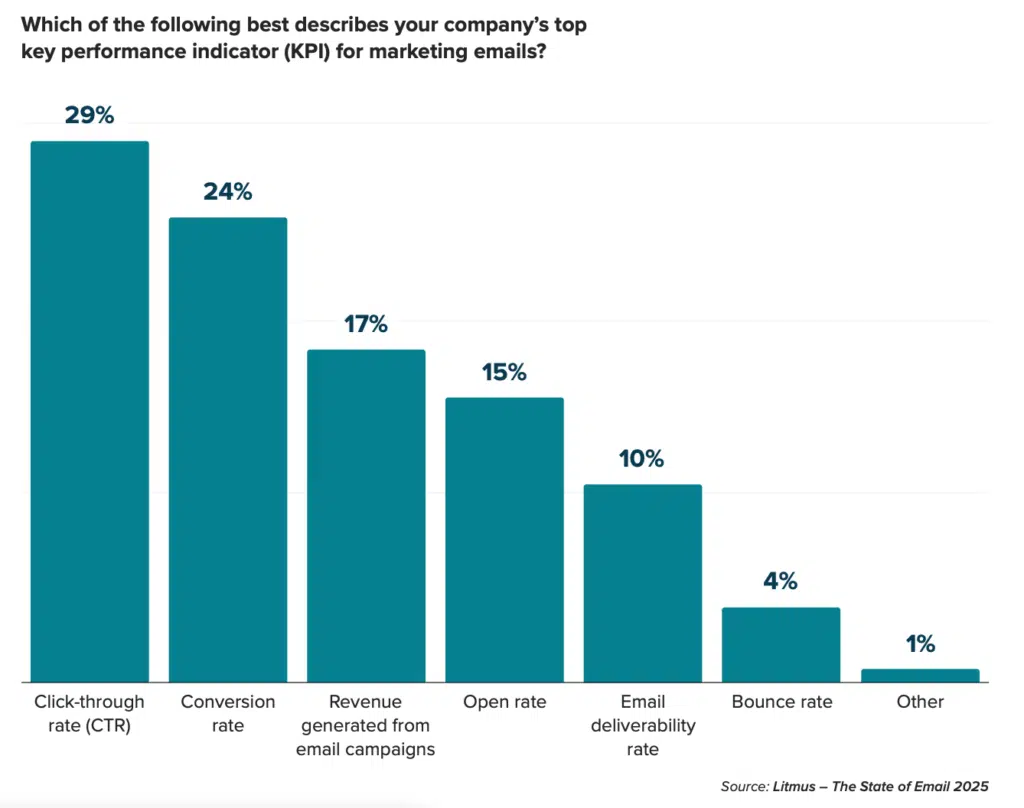

To gauge the effectiveness of their email campaigns, financial services teams often focus on key performance indicators (KPIs). According to Litmus' 2025 State of Email Report, the most common KPI for email marketing is the click-through rate (CTR), with 29% of companies prioritizing it.

This highlights how important email engagement is to financial teams using Salesforce for communication.

1. Data governance and role-based access controls

Salesforce supports financial services email marketing by controlling who can access customer data and who can send emails.

Key capabilities include:

- Role-based access: Only approved users can create, send, or modify emails, which limits internal risk.

- Profile and field-level controls: Teams can restrict access to sensitive customer and financial data based on role.

- Centralised template control: Admins can manage approved email templates in one place, which supports compliance review before emails go live.

As governance needs increase, many financial services teams extend these native controls with Salesforce-native tools such as MassMailer, which offer a controlled email template builder, approval workflows, and clearer visibility, all while keeping email activity fully inside Salesforce.

2. Consent management and communication preferences

Salesforce supports compliant email marketing for finance teams by enforcing consent at the customer record level.

This works because:

- Preferences live in Salesforce: Opt-ins, opt-outs, and channel permissions stay tied to each contact and account.

- Send-time enforcement: Emails respect these preferences automatically, which reduces accidental violations.

- Shared visibility: Marketing, sales, and service teams reference the same consent data, avoiding conflicting communication.

For organisations managing large customer bases, consent-driven sending works best when preference checks remain native to Salesforce. Reviews on SoftwareFinder highlight how Salesforce-integrated tools like MassMailer help teams apply consent rules consistently while keeping customer data and communication controls inside the CRM.

3. Email activity logging, reporting, and audit trails

Salesforce supports financial services email marketing by logging and reporting email activity directly against customer records.

This creates value because:

- Every email is recorded: Messages link to accounts and contacts for clear traceability.

- Salesforce reporting: Teams can report on email activity, sender behaviour, and communication history inside the CRM.

- Audit-ready records: Compliance and risk teams can review what was sent, by whom, and when.

At higher volumes, native reporting can become harder to analyse in detail. Salesforce-native solutions like MassMailer extend email reporting with configurable alerts that notify teams about sending activity, delivery issues, or anomalies, while still preserving Salesforce’s audit trail, which many regulated teams prefer.

With these controls in place, the next step is understanding where Salesforce email marketing reaches its limits for financial services teams, especially as scale, governance demands, and compliance pressure increase.

Limitations of Salesforce email marketing for financial services teams

Salesforce email marketing has clear strengths for financial services, but it also has limits that teams need to understand before scaling regulated communication.

While Salesforce keeps email activity inside the CRM, native capabilities can struggle as volume, governance needs, and compliance pressure increase. As a result, finance teams often review these limits early to avoid risk later.

1. Native email sending constraints

Salesforce email marketing for financial services teams can feel restrictive when email volume grows.

Key constraints include:

- Send limits: Daily and hourly limits can restrict large client updates or lifecycle campaigns.

- Manual oversight: Native tools rely heavily on admins to monitor usage and errors.

- Limited flexibility: Teams may need workarounds for controlled bulk communication.

Because of these limits, many finance teams look for Salesforce-aligned email solutions that support higher volumes without bypassing CRM controls. AppExchange tools such as MassMailer often appear in these evaluations because they extend sending capacity while keeping data and activity inside Salesforce.

2. Compliance and governance gaps at scale

Salesforce email marketing can meet basic governance needs, but gaps appear as teams grow.

These gaps often include:

- Template approval workflows: Native controls may not support structured review before emails go live.

- Ongoing compliance checks: Teams may lack alerts for unusual sending behaviour or policy breaches.

- Audit preparation effort: Reviewing large volumes of email activity can become time-consuming.

As governance needs increase, many financial services teams strengthen native Salesforce controls with AppExchange solutions such as MassMailer, which support Salesforce email authentication to ensure sender identity, policy enforcement, and audit readiness without moving email activity outside Salesforce.

Understanding these limitations matters because the next step for most financial services teams is learning how compliance, risk, and business teams evaluate Salesforce email capabilities before committing to a long-term setup.

How financial services teams evaluate Salesforce email capabilities

Financial services teams evaluate Salesforce email capabilities by checking whether the platform meets compliance, governance, and audit needs before scaling customer communication.

Rather than focusing on campaign features, teams assess how Salesforce handles risk, control, and accountability across email activity. As a result, evaluation often involves compliance, risk, IT, and business teams reviewing the same criteria.

Criteria used by compliance and risk teams

Compliance and risk teams focus on whether Salesforce email marketing can support regulated communication without creating exposure.

They typically assess:

- Consent enforcement: Emails must respect opt-in and preference rules stored in Salesforce at send time.

- Sender authentication: Email sending should support a clear sender identity and policy enforcement to reduce spoofing and misuse.

- Access controls: Only approved users should be able to create, edit, or send emails.

- Audit readiness: Every email must be traceable to a user, record, and time for review.

When gaps appear, teams often review Salesforce-native guidance like MassMailer on topics like Salesforce email authentication to understand how authenticated sending, sender reputation monitoring, and delivery signals help reduce compliance risk.

Key decision factors for platform suitability

Business and technology teams then evaluate whether Salesforce email marketing fits long-term operational needs.

Common decision factors include:

- Scalability: Can the setup support growing customer lists and regulated sends without manual work?

- Governance overhead: Does oversight increase as volume grows, or do controls scale with it?

- Reporting clarity: Can teams easily review email activity, trends, and exceptions inside Salesforce?

- Integration approach: Does the solution stay Salesforce-native or rely on external systems?

At this stage, many financial services teams compare native Salesforce capabilities with AppExchange options like MassMailer, focusing on Salesforce email integration that keeps governance, reporting, and authenticated email execution fully within the CRM rather than relying on external systems.

Taken together, these evaluation steps help financial services teams decide whether Salesforce email marketing is sufficient on its own or whether additional Salesforce-native controls are needed to meet compliance and scale expectations.

Decision summary: When Salesforce email marketing is enough, and when teams add native tools

Salesforce email marketing is enough for financial services teams when email volume is low, communication is tightly controlled, and compliance reviews remain simple.

In these cases, teams rely on Salesforce to manage customer data, enforce consent, and log email activity without adding extra layers. This setup works well for service updates, one-to-one communication, and limited regulated outreach where oversight stays manageable.

However, the decision changes as scale and complexity increase.

When Salesforce email marketing is usually sufficient

Salesforce alone often works when:

- Email volume stays moderate: Teams send controlled messages rather than frequent bulk communication.

- Few senders are involved: Access remains limited to a small, approved group.

- Compliance checks are straightforward: Reviews focus on individual sends rather than patterns or trends.

- Reporting needs are basic: Teams only need standard activity logs inside Salesforce.

In these scenarios, Salesforce email marketing for financial services provides enough structure to stay compliant without adding operational overhead.

When financial services teams add Salesforce-native tools

As communication grows, many teams find that native Salesforce features no longer scale cleanly.

Teams usually add Salesforce-native tools when:

- Email volume increases: Monitoring activity manually becomes difficult.

- Governance needs to be tightened: Templates, approvals, and sender rules require more structure.

- Audit reviews deepen: Compliance teams need faster access to reports and alerts.

- Sender trust matters more: Teams want better visibility into authentication and sender reputation signals.

This is where Salesforce email integration plays a key role. Financial services teams often evaluate AppExchange options like MassMailer because they extend reporting and authenticated sending while keeping all email activity inside Salesforce.

A simple rule helps most teams decide.

- If Salesforce email marketing still feels easy to review, approve, and explain during compliance checks, it is likely sufficient.

- If reviews start to feel manual, slow, or reactive, adding Salesforce-native controls like MassMailer usually becomes the safer option.

With that decision framework in place, the final step is summarising what this means for financial services teams using Salesforce email marketing and how to apply these insights in practice, which we cover next.

Conclusion

Salesforce email marketing provides a powerful foundation for financial services teams to manage customer communication securely and compliantly. However, as teams scale their efforts, the need for enhanced governance, reporting, and control becomes evident. By understanding Salesforce’s native capabilities and evaluating where additional tools, like MassMailer, fit in, teams can ensure their email marketing remains both efficient and compliant.

For teams in regulated industries, staying ahead of compliance challenges is crucial. By integrating Salesforce with the right native tools, financial services teams can maintain secure, traceable, and compliant email communication at scale.

If you're ready to enhance your Salesforce email marketing and ensure it’s fully compliant with industry regulations, request a demo of MassMailer today. See how easy it is to integrate authenticated sending, reporting, and compliance-focused tools directly within Salesforce to manage your email marketing more effectively.

Frequently Asked Questions

1. How does Salesforce email marketing work for financial services?

2. What are the compliance challenges in Salesforce email marketing?

3. What is Salesforce email authentication?

4. Why do financial services need email marketing tools in Salesforce?

5. How can Salesforce email marketing improve reporting in financial services?

6. How do Salesforce-native tools handle email governance in financial services?

Start Your Free Trial Today

Experience MassMailer the easiest way to send personalized emails from Salesforce.

Related Blogs

Salesforce Platform Overview: How It Works and When It Fits

Salesforce Sales Email Best Practices That Drive Results

Salesforce Lightning App Builder: Build Custom Pages Without Code

MassMailer Resources

MassMailer Glossary